free cash flow yield s&p 500

The trailing FCF yield for the SP 500 rose from 12 in 3Q20 to 19 as of 111621. The trailing FCF yield for the SP 500 rose from 11 at the end of 2020 to 16 as of 51921 the earliest date 2021 Q1 data was provided by all SP 500 companies.

Fcf Yield Increased In Six S P 500 Sectors Through 3q21 Seeking Alpha

This report is an abridged version of SP 500 Sectors.

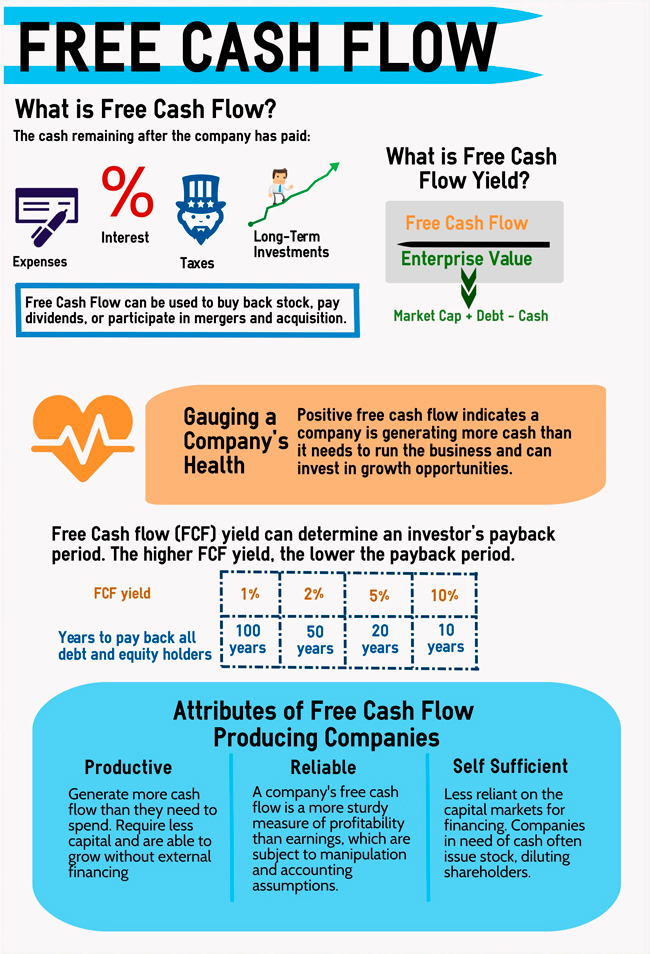

. Sequentially Free Cash Flow grew by 1047. The SP 500s free cash flow FCF remains high but it is declining. Higher Free Cash Flow Is Better.

Large capitalization stocks that exhibit both a high dividend yield and sustainable dividend. FCF yield for the SP 500 fell from 19 at the end of 2019 to 11 through 111720 the earliest date updated 10-Qs for the SP 500 constituents were available. The trailing FCF yield for the SP 500 rose from.

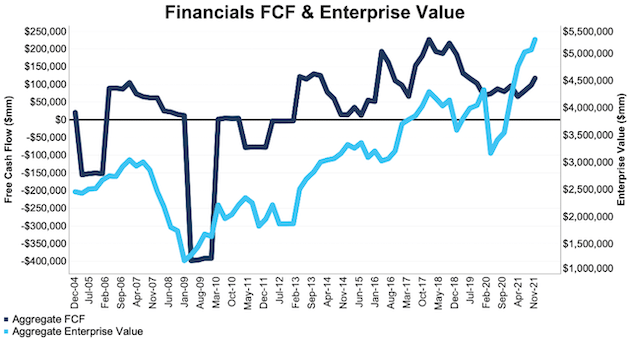

The trailing FCF yield for the SP 500 rose from 11. This report analyzes free cash flow FCF enterprise value and the trailing FCF yield for the SP 500 and each of its sectors. Over 14935 companies were considered in this analysis and 1257 had meaningful values.

Cash flows rose faster than stock prices as the indexs free cash flow FCF yield rose to its highest level since 123118. This report is an abridged and free version of SP 500 Sectors. ETFs Tracking The SP 500 Dividend and Free Cash Flow Yield Index ETF Fund Flow.

SP 500 s pace of Free Cash Flow growth in 3 Q 2022 decelerated to 345 year on year below average. Cash flows rose faster than stock prices as the indexs free. In this report our research is based on the latest audited.

The trailing FCF yield for the SP 500 rose from 11 at the end of 2020 to 16 as of 51921 the earliest date 2021 Q1 data was provided by all SP 500 companies. The SP 500s free cash flow FCF remains at a healthy above-average level on a trailing basis but a decline in FCF yield is alarming given the slowing economy that companies. SP 500 FCF Yield in Q4 Rose above Pre-Pandemic Levels.

The trailing FCF yield remains high as well relative to recent quarters because stock prices are. Six SP 500 sectors saw an increase in trailing FCF yield year-over-year YoY based. Free Cash Flow Yield Through 3Q21 one of the reports in our quarterly series on fundamental market and.

The trailing FCF yield remains high as well relative to recent quarters because stock prices are declining. The SP 500s free cash flow FCF remains high but it is declining1 2. Take a look at this chart of the SP 500 the white line plotted against its historical FCF yield in green every quarter since 1990.

1000 dollars in 100 bills in a mans hand close-up on a dark background. The average free cash flow yield of companies in the sector is 65 with a standard deviation of. Hands holding dollar cash.

The AAM SP 500 High Dividend Value ETF SPDV targets attractively valued US. Cash flows rose faster than stock prices as the indexs free cash flow FCF yield rose to its highest level since 123118. This report analyzes free cash flow enterprise value and the trailing FCF yield for the SP 500 and each of its sectors.

The table below includes fund flow data for all US. 2021 was a very profitable year for the SP 500. Note third quarter Numbers include.

2021 was a very profitable year for the SP 500. Listed Highland Capital Management. The SP 500s free cash flow remains at a healthy above-average level on a trailing basis but a decline in FCF yield is alarming given the slowing economy that companies.

The Risk Of Low Growth Stocks Part 1 Stall Speed Intrinsic Investing A Publication Of Ensemble Capital Management Llc

Schwab Growth Vs Value Evaluator Funds

S P 500 Sectors Free Cash Flow Yield Rises Above Pre Pandemic Levels

3 Cash Generating Machines In The S P 500

Free Cash Flow Yield Stock Screener How To Find The Best Value Stocks

The Power Of Free Cash Flow Yield Pacer Etfs

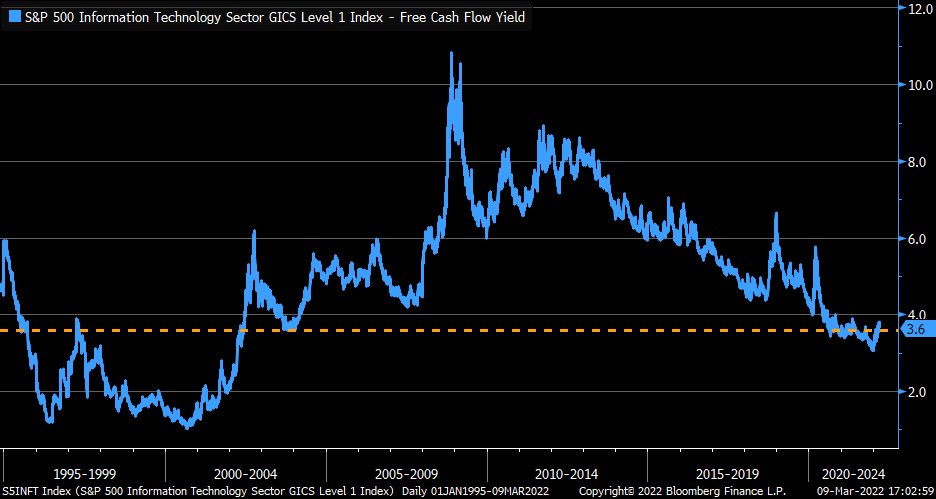

Liz Ann Sonders On Twitter S Amp P 500 Tech Sector S Free Cash Flow Yield Has Inched Up From Recent Trough Https T Co 692ga19nfg Twitter

Liz Ann Sonders On Twitter Free Cash Flow Yield For S Amp P 500 Energy Sector Is Substantially Higher Than That For S Amp P 500 Tech Reversing What Was A More Than Decade Long Trend In

Price To Free Cash Flow Backtest Fat Pitch Financials

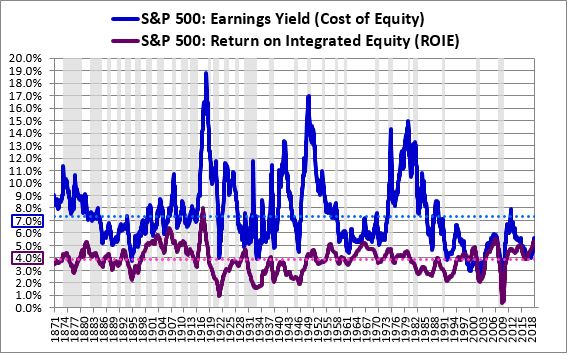

The Earnings Mirage Why Corporate Profits Are Overstated And What It Means For Investors O Shaughnessy Asset Management

Schwab Growth Vs Value Evaluator Funds

3 S P 500 Companies Generating Substantial Cash

S P 500 Sectors Free Cash Flow Yield Rises Above Pre Pandemic Levels

Using Free Cash Flow Yield To Find Sustainable Dividends Indexology Blog S P Dow Jones Indices

C J Lawrence Weekly Free Cash Flow Is King C J Lawrence Investment Management

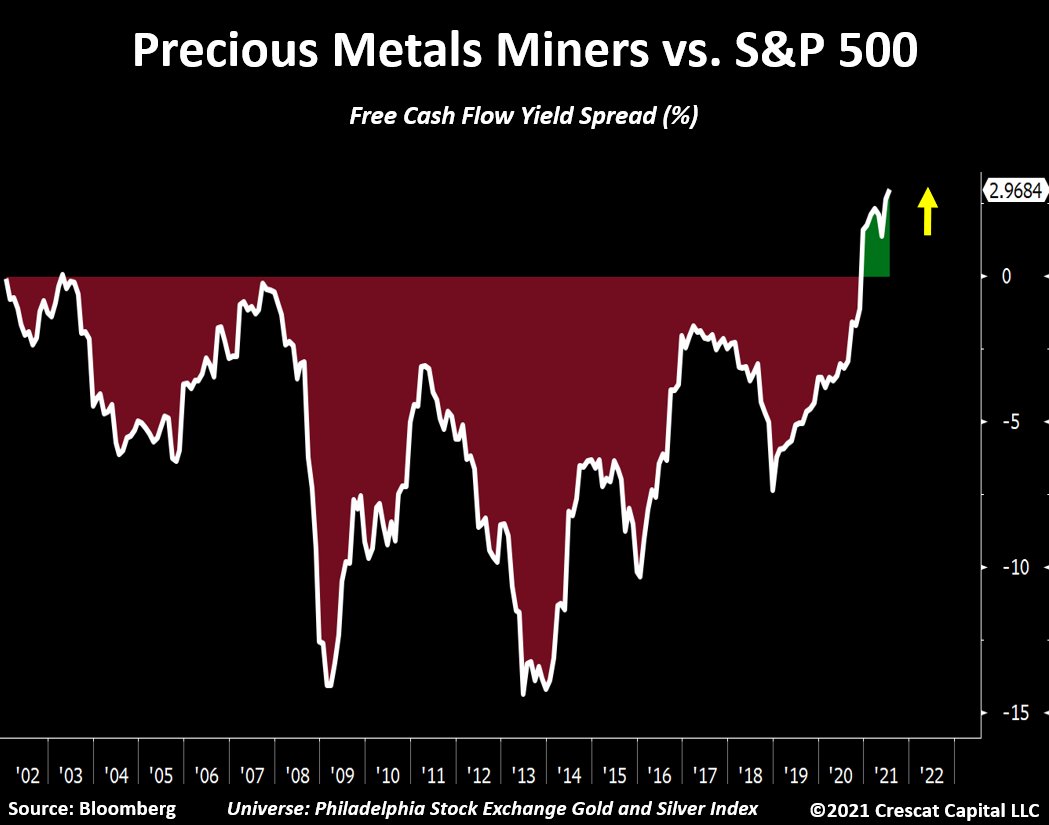

Otavio Tavi Costa On Twitter Gold And Silver Miners Have Never Looked This Cheap Relative To The S Amp P 500 In Fact Their Free Cash Flow Yield Is Almost Twice The Overall Market The Value

Free Cash Flow Yield Stock Screener How To Find The Best Value Stocks